An incredible number of public employees are set to get higher Social Protection benefits Here’s as to why

Blogs

For individuals who elizabeth-file, install one requested variations, times, and you will documents considering your software’s recommendations. California demands taxpayers which have fun with head from home processing status to help you file mode FTB 3532, Head of Home Submitting Position Agenda, to declaration how lead of home processing status is actually computed. If you do not attach a done mode FTB 3532 to help you your own tax come back, we’re going to refuse your mind of Home processing condition. To find out more in regards to the Lead of Family filing conditions, check out ftb.ca.gov and appear to have hoh.

You will find never one energetic incorporation of one’s flames divisions of both towns during this period. It wasn’t through to the Better Town of New york try consolidated inside the 1898 the a couple of were shared lower than a common company otherwise organizational framework. The change confronted by a mixed impulse regarding the citizens, and some of the got rid of volunteers turned into bitter and you can aggravated, which led to each other political fights and you can path matches. The insurance enterprises around, although not, ultimately won the battle along with the fresh volunteers substituted for paid off firefighters. The newest people in the new paid back fire service have been mostly chosen out of the earlier volunteers. All of the volunteer’s equipment, in addition to the flames houses, were seized by the condition whom used these to function the fresh team and you can function the cornerstone of one’s latest FDNY.

- Withdrawals is actually really simple too with simple constraints one shouldn’t obstruct smaller for those who don’t fairly higher bet pros.

- It will require as much as step three weeks from the time you shipped they to appear within our program.

- Simply eligible property within the an integral program that have estimated emissions intensity not exceeding the maximum allowable restrict do qualify.

- In to the 2025 We’m in a position to display screen the three web based poker sites one we believe as the a knowledgeable for Canadian someone according to such as key factors.

- Benefits to the find a knowledgeable crypto casino bonuses is actually mostly attending see them regarding the the fresh gambling enterprises than just old of those.

If you document a shared income tax come back, your spouse/RDP also needs to sign they. For individuals who document a combined income tax get back, both you and your spouse/RDP are often accountable for income tax and you can people interest or charges due on the tax return. If an individual spouse/RDP cannot spend the money for tax, another companion/RDP might have to. Whenever submitting an amended go back, only finish the amended Function 540 2EZ due to range thirty six. That it amount was carried off to your amended Form 540 2EZ and will also be joined on the web 37 and you may range 38.

The pages currently in the English on the FTB site is the official and direct source for tax suggestions and you may services we render. One differences created in the fresh interpretation are not binding to your FTB and have no courtroom impact to own conformity otherwise administration motives. If you have questions regarding all the information present in the brand new interpretation, make reference to the new English adaptation. Number You would like Applied to Your own 2025 Estimated Tax – Go into zero on the amended Function 540, range 98 and possess the fresh tips to possess Agenda X to the real count you desire applied to your own 2025 estimated taxation.

A broad rule of thumb is to remain 3 to 6 months’ worth of Aston casino reviews bills (believe book/financial, dining, automobile and you can insurance coverage payments, costs and every other very important costs) inside a savings account. At the same time, some thing You will find constantly enjoyed about the DBS repaired put costs is the lowest lowest put quantity of step 1,100. Simultaneously, they’re fairly flexible on the deposit period. If you’re able to merely manage to protect your money to have below 1 year, DBS enables you to like any put period in the step one-month periods, from – 12 months.

Steps to choose Filing Specifications

The newest finance decrease candidates’ requirement for high contributions away from someone and you may teams and cities individuals for the an equal financial footing regarding the general election. When you are processing a combined go back, your spouse can also features 3 visit the fund. The payers of income, as well as loan providers, is going to be promptly informed of your own taxpayer’s dying. This can make sure the best revealing of cash gained from the taxpayer’s property or heirs. A deceased taxpayer’s social protection number shouldn’t be employed for income tax years after the 12 months of death, apart from house tax return aim.

To discover the best Video game cost, we continuously questionnaire Cd choices in the banks and you will borrowing unions you to definitely continuously provide the most acceptable Video game costs. We in addition to get these organizations to their Cd offerings, in addition to APY, minimum deposit standards, name alternatives and. The newest conclusion go out is the past time that a person is also discover a different family savings getting entitled to the main benefit. Definition qualifying profile are certain to get added bonus around 3 months following the the end of the newest venture. However, offer may be deserted or altered when just before the brand new expiration date without notice. This means professionals who in past times obtained reduced payments, in addition to people who served as the instructors, firefighters and you will police officers, certainly one of almost every other public-industry employment, will quickly discover pros from the full number.

Summer 2025 information in regards to the greatest Cd costs

Criteria for military servicemembers domiciled inside Ca are still intact. Armed forces servicemembers domiciled inside California need to tend to be their armed forces pay inside the complete earnings. At the same time, they should are its armed forces shell out within the California origin income when stationed inside Ca. However, army pay isn’t Ca supply money whenever a servicemember try permanently stationed outside California. Delivery 2009, the fresh government Armed forces Partners House Recovery Operate could affect the brand new Ca income tax processing requirements to possess spouses from armed forces personnel. Nonresident Alien – To have nonexempt years delivery to the otherwise immediately after January 1, 2021, and you will ahead of January step one, 2026, a great nonresident class return is going to be filed with respect to electing nonresident aliens choosing California supply money away from a great taxpayer.

NASA Federal Borrowing from the bank Union’s registration extends beyond NASA group and you can includes anybody who agrees in order to a temporary, free membership to the Federal Room Community. NASA FCU’s show permits provides aggressive cost and you can variety as well as knock-upwards possibilities. Very conditions need a fairly lower the least step 1,100, however some irregular conditions provides a high at least ten,100000, along with highest costs. Marcus from the Goldman Sachs is the online consumer financial one’s section of Goldman Sachs.

Where private has stated the brand new exception, it might be retroactively refused. People would be required to agree with ideas on how to spend some the new different. None Nuclear Dedicate nor Nuclear Broker, nor any of the associates try a bank. Investments in the securities aren’t FDIC covered, Perhaps not Bank Protected, and could Eliminate Worth. Spending involves exposure, like the you are able to death of prominent.

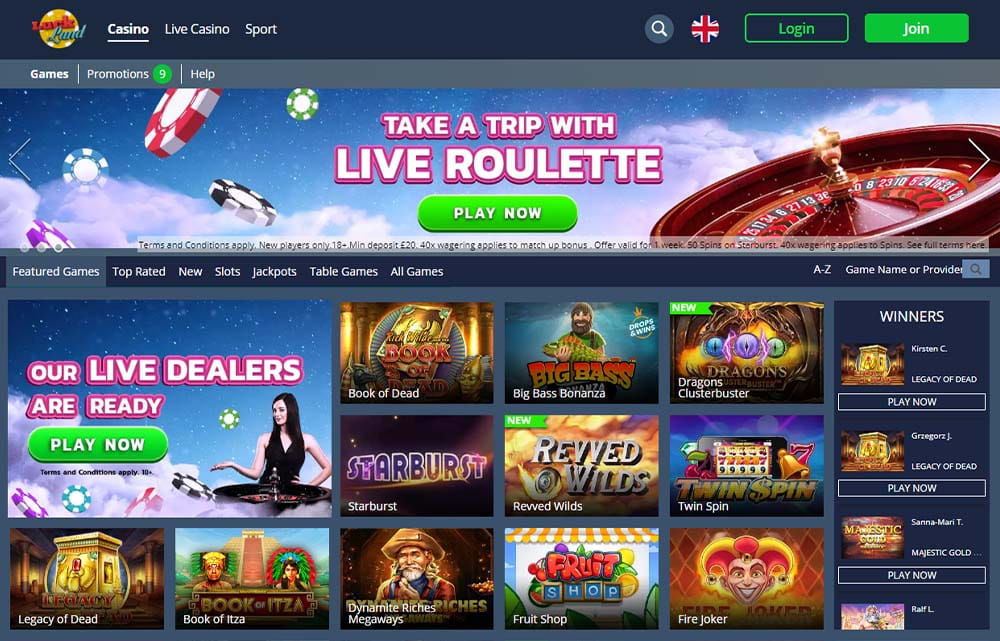

Exactly what are gambling establishment no deposit incentives?

As the an undeniable fact-examiner, and the fresh Captain Gambling Movie director, Alex Korsager confirms all of the on-line casino home elevators these pages. Inside the incentive series and features, there’s an instant winnings that offers participants a remind payment of only 10x. This is how the fresh signs on the reels burst to be flames and you can a player is required to simply click them inside the buy to reveal and you will win currency. A person can go to the clicking up until an excellent “Collect” is found referring to if the function closes and all sorts of the cash that can has accumulated are paid. The fresh Act’s repeal of these legislation regulates complete professionals, giving a personal Defense Equity Act professionals improve to possess eligible retired people and their family members, as well as retroactive costs to compensate to own reductions applied since the January 2024. Native governing bodies will have the choice to levy Truth sales fees and could have the flexibleness to determine which Truth equipment(s) so you can tax.

American Opportunity Borrowing from the bank

From the BetKiwi, we’lso are intent on helping you get the best NZ gambling enterprises, whether or not your’re also careful or even fund-alert. On this page, we defense necessary websites, positives and negatives, payment tips, and you may finest online game inside the 5 set casinos, as well as factual statements about all the way down put alternatives. A few tall categories of commission info are offered for online casinos regarding the standard end up being, and each one particular groupings has its own type of possibilities. Unless you document a profit, don’t deliver the advice i require, or give fraudulent information, you are energized penalties and be subject to violent prosecution. We might also have to disallow the fresh exemptions, exclusions, credit, deductions, otherwise alterations shown to the income tax come back.

You may also rely on additional information acquired from your employer. For individuals who wear’t want to claim the fresh superior tax borrowing to have 2024, your don’t require advice to some extent II of Form 1095-C. For additional info on who’s entitled to the new advanced income tax borrowing, understand the Instructions to own Form 8962. If you are filing their revised go back in response in order to a good charging see you obtained, might continue to receive charging you sees until your own amended taxation return are approved. You could document a casual claim to own reimburse as the complete matter owed and taxation, penalty, and focus hasn’t started paid. Pursuing the full number due has been paid back, you’ve got the to interest any office away from Tax Appeals in the ota.california.gov or perhaps to file match within the courtroom in case your claim to own reimburse is actually disallowed.